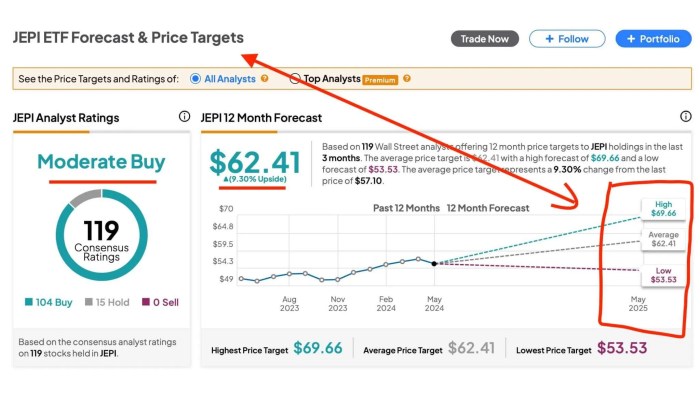

Embark on a journey of understanding as we delve into JEPI vs. GM: Investment Insights for Beginners. This comprehensive guide offers valuable insights into the world of investments, shedding light on key differences and performance metrics to empower novice investors.

Learn how to navigate the complexities of JEPI and GM to make informed decisions for a secure financial future.

Introduction to JEPI and GM

JEPI and GM are both investment options that offer opportunities for individuals to grow their wealth over time. However, they have distinct characteristics that set them apart in terms of risk and potential returns.

Definition of JEPI and GM

JEPI stands for Joint Equity Participation Investment, which involves pooling funds from multiple investors to invest in various equity assets. GM, on the other hand, refers to Growth Mutual Funds, which are professionally managed investment funds that aim to provide capital appreciation over the long term.

Differences Between JEPI and GM

- JEPI typically involves direct ownership of equities, allowing investors to benefit from dividends and capital gains. In contrast, GM invests in a diversified portfolio of securities, providing investors with exposure to a wide range of assets.

- JEPI investors have a more active role in decision-making regarding their investments, while GM investors rely on fund managers to make investment decisions on their behalf.

- Historically, JEPI has shown higher volatility due to its direct equity exposure, whereas GM offers a more balanced approach with potentially lower risk.

Historical Performance of JEPI and GM

Over the years, JEPI has demonstrated the potential for significant returns during bull markets but can experience sharp declines during market downturns. GM, on the other hand, has shown more stability in performance due to its diversified holdings, which can help mitigate risk in volatile market conditions.

Risk Analysis

Investing in JEPI and GM both come with their own set of risk factors that beginners should be aware of. Understanding these risks is crucial for making informed investment decisions.

Comparison of Risk Factors

- JEPI: JEPI, being an exchange-traded fund (ETF) focused on environmental, social, and governance (ESG) factors, may be subject to risks associated with sustainability trends and regulatory changes.

- GM: Investing in individual companies like GM involves company-specific risks such as competition, market demand, and operational challenges.

Impact of Market Volatility

Market volatility can affect JEPI and GM differently due to their distinct investment focuses. JEPI may be more resilient during market downturns due to its ESG screening criteria, while GM’s stock price may be more susceptible to market fluctuations based on company-specific news and events.

Unique Risks

- JEPI: One unique risk for JEPI is the potential impact of changing ESG trends and regulations on the performance of the fund.

- GM: GM faces unique risks related to the automotive industry, such as technological disruptions, supply chain issues, and shifts in consumer preferences.

Investment Strategies

When it comes to investment strategies for JEPI and GM, there are a few key approaches that beginners can consider to maximize their returns while managing risks effectively.

Diversification Benefits

One of the main benefits of investing in both JEPI and GM is diversification. By holding a mix of assets from different sectors or industries, investors can reduce the overall risk of their portfolio. JEPI, with its focus on emerging markets, provides exposure to high-growth potential, while GM offers stability and consistent returns in the automotive industry.

Allocation for a Balanced Portfolio

- Beginners can consider allocating a higher percentage of their funds to JEPI if they have a higher risk tolerance and are looking for growth opportunities in emerging markets.

- On the other hand, investing more in GM can provide stability and steady returns, making it suitable for conservative investors or those looking for dividend income.

- A balanced approach could involve splitting funds evenly between JEPI and GM to benefit from both growth potential and stability in one’s portfolio.

Growth Potential

Investing in JEPI and GM requires a careful consideration of their growth potential. Analyzing the factors that may influence the future growth of these companies is essential to make informed investment decisions. Moreover, understanding how economic conditions can impact their growth trajectories is crucial for maximizing returns.

Factors Influencing Growth

- Market Demand: JEPI operates in the tech industry, which has shown continuous growth due to increasing demand for innovative solutions. On the other hand, GM operates in the automotive sector, which is subject to fluctuations in consumer preferences and economic conditions.

- Technological Advancements: JEPI’s growth potential is closely tied to its ability to innovate and stay ahead of competitors in the rapidly evolving tech landscape. GM’s growth, on the other hand, depends on its capacity to adapt to technological changes in the automotive industry.

- Regulatory Environment: Both JEPI and GM are affected by regulations that govern their respective industries. Changes in policies related to data privacy, emissions, or trade can significantly impact their growth prospects.

Economic Impact

- Global Economic Conditions: Fluctuations in global economic conditions such as GDP growth, inflation rates, and interest rates can influence consumer spending patterns, affecting both JEPI and GM’s revenue streams.

- Supply Chain Disruptions: Economic disruptions like trade wars or natural disasters can disrupt the supply chain of both companies, impacting their production capabilities and growth potential.

- Investor Sentiment: Economic uncertainty can lead to fluctuations in investor sentiment, affecting stock prices of JEPI and GM. Positive economic outlooks can boost investor confidence and drive growth in both companies.

Conclusion

In conclusion, JEPI vs. GM: Investment Insights for Beginners equips you with the knowledge needed to kickstart your investment journey with confidence. Armed with a deeper understanding of these options, you can navigate the financial landscape with clarity and purpose.

Quick FAQs

What are the unique risks associated with JEPI and GM?

JEPI carries market risk due to its exposure to equity markets, while GM may face interest rate risk. Beginners should carefully consider these factors.

How can beginners allocate funds between JEPI and GM?

Beginners can opt for a balanced approach by diversifying their portfolio with both JEPI and GM based on their risk tolerance and investment goals.

What factors influence the growth potential of JEPI compared to GM?

The growth potential of JEPI may be influenced by market conditions, while GM’s growth trajectory could be impacted by economic indicators.